The Private Investment Management Program

As a “discretionary” account, your investment account through the PIM program is structured to let our team’s portfolio manager make investment decisions on your behalf, based on your risk tolerance and financial objectives. As your advisor, the portfolio manager will guide you through our process to obtain your investment goals and risk parameters and then use asset allocation to construct a personalized portfolio to help meet your financial objectives.

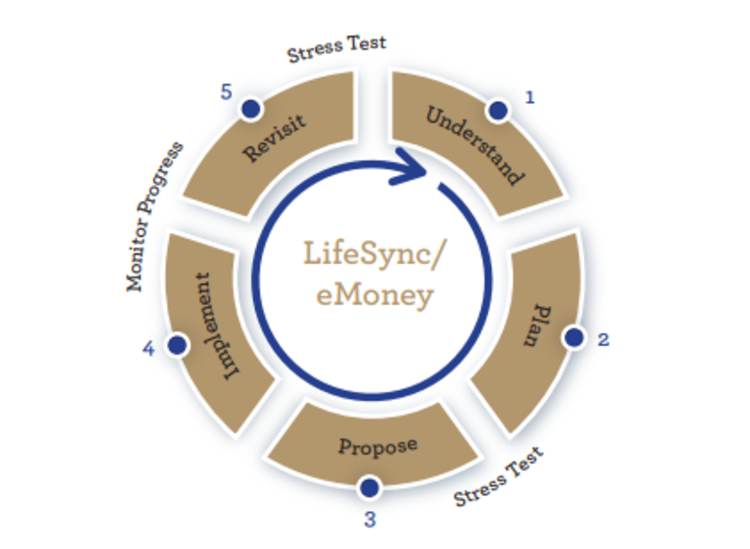

Our LifeSync/eMoney Process

-

Understand: Meet and listen, then preparing a detailed financial framework that outlines current strategies.

-

Plan: Our analysis will take a thousand different historical market scenarios and stress test your set of goals to determine our chances of success.

-

Propose: We propose strategies to reflect your financial objectives and desires.

-

Implement: We will deploy assets into your mutually agreed upon allocation.

-

Review Progress: We will review your plan to ensure that we are staying on track to meet your goals.

-

Revisit: We get together to review your financial advisory plan at least annually.

Learn More

IMPORTANT: The projections or other information generated by eMoney regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time. Based on accepted statistical methods, eMoney uses a mathematical process used to implement complex statistical methods that chart the probability of certain financial outcomes at certain times in the future. This charting is accomplished by generating hundreds of possible economic scenarios that could affect the performance of your investments. Using Monte Carlo simulation this report uses up to 1000 scenarios to determine the probability of outcomes resulting from the asset allocation choices and underlying assumptions regarding rates of return and volatility of certain asset classes. Some of these scenarios will assume very favorable financial market returns, consistent with some of the best periods in investing history for investors. Some scenarios will conform to the worst periods in investing history. Most scenarios will fall somewhere in between.

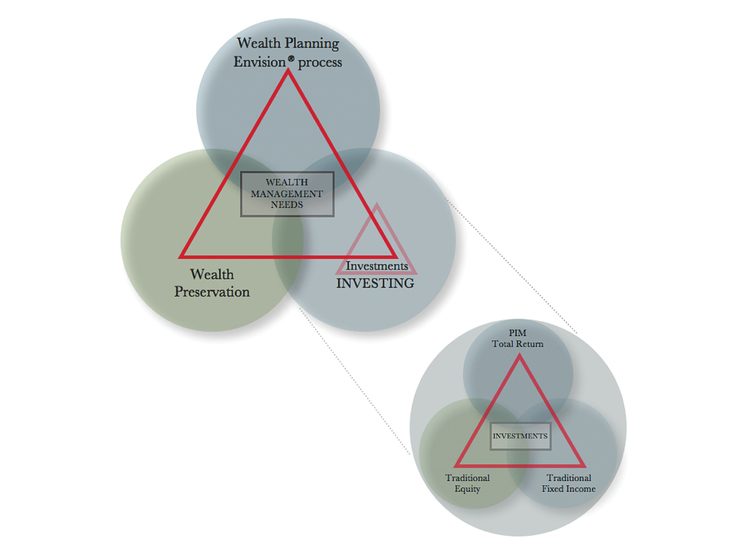

Triangle and One

The Private Investment Management (PIM) Program offers customized investment portfolios that can include cash alternatives, stocks, bonds, mutual funds, closed-end funds, option strategies, and exchange-traded funds in a single account.

Learn More

The PIM program is not designed for excessively traded or inactive accounts and is not appropriate for all investors. Please carefully review the Wells Fargo Advisors advisory disclosure document for a full description of our services. The minimum account size for this program is $50,000.

“You don’t choose your family. They are God’s gift to you, as you are to them.”

— Desmond Tutu