Investment Management

We believe in owning individual stocks and are classically trained in evaluating and buying them. We favor their ability unlike funds to offer more control over capital gains and losses, and, because of our long holding period, they tend to be cheaper than funds in the long run.

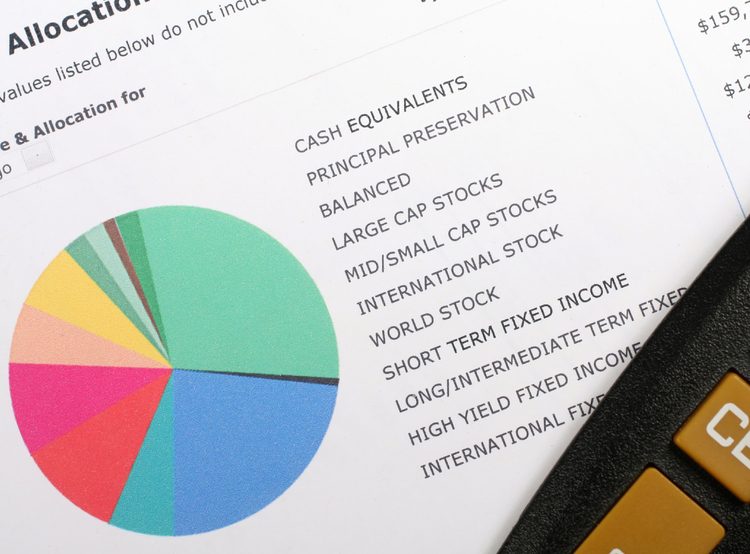

Building Your Investment Portfolio

We rely on the following principles, although each one has many layers of depth:

-

Diversify

-

Buy Quality

-

Pay a fair price

-

Be willing to hold for a long time

-

When a stock drops, find the facts and then face the facts

Bond Laddering

A bond ladder spreads investment dollars among bonds that mature at various times between one year and 30 years. Laddering bonds enables investors to reinvest assets periodically over time to help reduce the effect of interest-rate volatility in fixed-income portfolios. Bond laddering does not assure a profit or protect against loss in a declining market. See attached for further information.

Mutual Fund Management

Things I think are important when considering a fund:

-

Lower expense ratio’s

-

Low turnover

-

Managers tenure of at least 10 years

-

Management that you can trust

-

Been in existence for at least 10 years

-

Consistently out-performs the relevant indexes over market cycles

“Opportunity is missed by most because it is dressed in overalls and looks like work.”

— Thomas Edison